The Senate has rejected the written explanations submitted by the Nigerian National Petroleum Company Limited (NNPCL) regarding the alleged unaccounted ₦210 trillion uncovered in the financial reports of the Office of the Auditor-General of the Federation (OAuGF) covering 2017 to 2023.

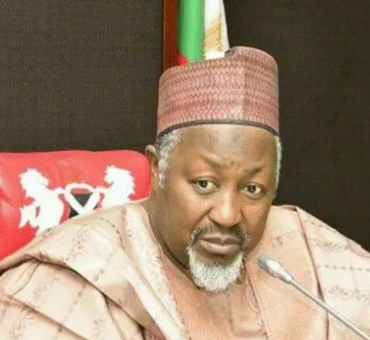

The decision was taken during a tense session of the Senate Committee on Public Accounts, chaired by Senator Aliyu Wadada (APC, Nasarawa West), on Tuesday.

The NNPCL management, which had been invited to appear before the committee to defend 19 audit queries raised against it, failed to send any representatives, opting instead to forward written responses to the lawmakers. The committee, however, deemed the responses unsatisfactory and inadequate, describing the corporation’s conduct as “offensive evasiveness.”

Senator Wadada expressed deep frustration over the company’s absence, particularly as the date for the appearance had been chosen by NNPCL itself.

“Today, November 11, 2025, was a date chosen by NNPCL,” he said. “It is rather unfortunate that none of its officials is here on a day they themselves picked. Nigerians have been waiting for answers, and the committee cannot continue to tolerate this level of disregard.”

He explained that while the committee would not make final pronouncements in the absence of the company’s representatives, it was necessary to inform Nigerians of the findings and concerns raised so far.

According to the senator, NNPCL’s financial submissions revealed significant inconsistencies and questionable figures, particularly in relation to ₦103 trillion reportedly spent on accrued expenses and ₦107 trillion recorded as receivables — amounting to ₦210 trillion within the seven-year period under review.

Wadada stated: “NNPCL claimed ₦103 trillion as accrued expenses and ₦107 trillion as receivables, but these figures raise serious red flags. The explanation provided for the ₦107 trillion in receivables, equivalent to about $117 billion, is inconsistent with the company’s own records and available evidence. The committee therefore rejects it.”

He further queried how the company could claim to have paid ₦103 trillion in cash calls to joint venture partners in 2023 alone, despite generating only ₦24 trillion in crude oil revenue between 2017 and 2022.

“Cash call arrangements were abolished as far back as 2016,” he said. “How then can NNPCL justify paying ₦103 trillion in one year when its total revenue for five years stood at ₦24 trillion? Where did NNPCL get that money? Such figures are unjustifiable and unacceptable. As far as this committee is concerned, that ₦103 trillion must be accounted for and returned to the treasury.”

The committee also dismissed NNPCL’s explanation that the ₦107 trillion in receivables represented assets held in defunct banks, describing the claim as vague and unsupported.

“NNPCL failed to name the banks or specify the amounts supposedly held there,” Wadada noted. “This level of opacity is completely unacceptable. If the present management cannot provide credible answers, the committee will not hesitate to summon former officials of NNPCL and the National Petroleum Investment Management Services (NAPIMS).”

He emphasized that NAPIMS, being a department under NNPCL, has no legal authority to operate an independent account, yet records showed that it had been functioning as a quasi-autonomous entity for years — a situation the Senate described as irregular and contrary to the law.

The committee chairman warned that the absence of NNPCL’s Group Chief Executive Officer (GCEO), Engineer Bayo Ojulari, at subsequent hearings would no longer be tolerated.

“At any point this committee invites NNPCL, the chief executive must appear in person,” Wadada stressed. “Being out of the country will no longer be accepted as an excuse. The next invitation will require his physical presence, and failure to comply will be viewed as contempt of the National Assembly.”

Other members of the committee unanimously supported the chairman’s stance, describing NNPCL’s conduct as an affront to parliamentary oversight and a deliberate attempt to frustrate accountability in the management of public resources.

The ₦210 trillion financial query is one of the largest discrepancies ever reported in Nigeria’s public audit history. Lawmakers insist that the magnitude of the figure demands full transparency and explanation, warning that any continued attempt to sidestep scrutiny would trigger tougher legislative measures, including subpoenas and potential sanctions.

The committee is expected to reconvene after reissuing a fresh summons to the NNPCL leadership for a physical appearance in the coming days.

Post comments (0)