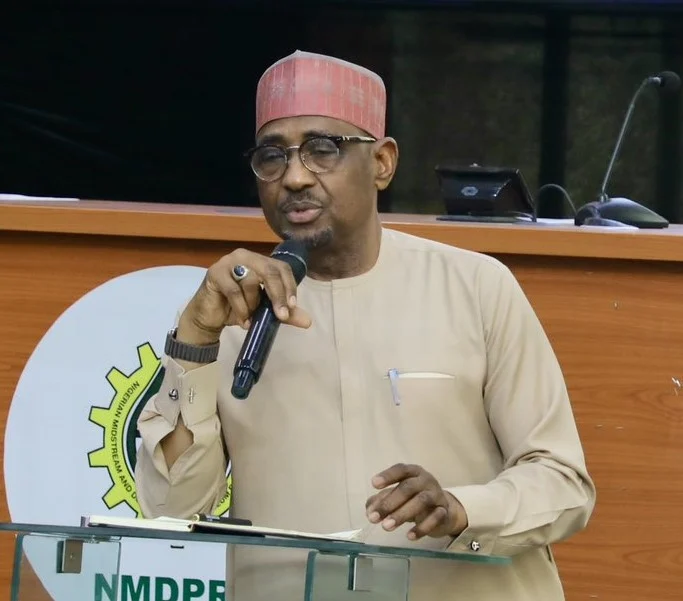

Nigeria’s petroleum sector was thrown into fresh uncertainty on Wednesday following the resignation of the Chief Executive of the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), Farouk Ahmed, and his counterpart at the Nigerian Upstream Petroleum Regulatory Commission (NUPRC), Gbenga Komolafe.

The resignations, announced by the Presidency, are widely viewed as fallout from the escalating dispute between the Dangote Refinery and regulators over fuel importation, pricing and regulatory oversight, as well as a petition filed by President of the Dangote Group, Aliko Dangote.

Dangote had accused Ahmed of economic sabotage and petitioned the Independent Corrupt Practices Commission (ICPC) to investigate allegations of unexplained wealth, including claims that the regulator spent about $5 million on the secondary education of his four children abroad. The allegations followed months of tension between the refinery and the NMDPRA over the issuance of fuel import licences and price competition in the downstream sector.

Ahmed was reportedly summoned to the Presidential Villa earlier on Wednesday, after which his resignation was announced. Although Komolafe was not directly involved in the immediate controversy, sources said the Federal Government opted for a simultaneous leadership change at both regulatory agencies.

Confirming the development, the Special Adviser to the President on Information and Strategy, Bayo Onanuga, said President Bola Tinubu had forwarded the names of new nominees to the Senate for confirmation.

According to him, Oritsemeyiwa Amanorisewo Eyesan has been nominated as Chief Executive of the NUPRC, while Engr. Saidu Aliyu Mohammed was nominated to head the NMDPRA. Both nominees were described as seasoned professionals with decades of experience in the oil and gas industry.

The sudden leadership changes have unsettled operators in the downstream oil sector. Marketers warned that the crisis could worsen instability, particularly following aggressive petrol price cuts by the Dangote Refinery, which they said had already eroded margins and disrupted business operations.

A senior industry source said the developments had heightened anxiety among marketers, many of whom were struggling to compete with Dangote’s pricing, especially on imported products already paid for at higher costs.

The dispute between Dangote and regulators dates back to 2024, shortly after the $20 billion Lekki refinery began fuel production. Dangote and his executives accused the NMDPRA of issuing licences for the importation of substandard products, forcing the refinery to export diesel and aviation fuel despite local demand.

The controversy deepened when Ahmed publicly questioned the quality of Dangote’s products and defended continued fuel imports on energy security grounds—comments that triggered widespread backlash.

Separately, tensions had also existed between the Dangote Refinery and the NUPRC over domestic crude supply obligations, with the refinery accusing regulators and oil companies of frustrating access to local crude, forcing it to import from abroad.

Industry analysts say the resignations have exposed deeper structural problems in Nigeria’s petroleum sector, including weak regulation and lingering trust deficits between investors and government agencies. Civil society groups and energy experts have called for full investigations into the allegations, insisting that leadership changes alone are not enough.

As new leadership prepares to take over, stakeholders across the oil and gas industry are watching closely to see whether the shakeup will restore confidence or further unsettle a sector already under pressure from a fierce petrol price war.

Post comments (0)