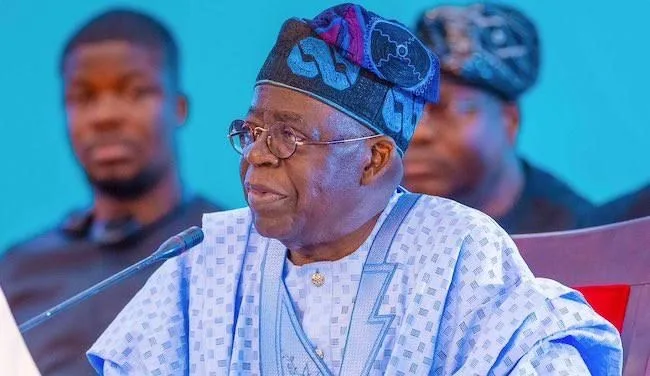

President Bola Tinubu has assented to the Nigerian Insurance Industry Reform Bill, 2025.

According to a statement issued on Tuesday by the President’s Special Adviser on Information and Strategy, Bayo Onanuga, the new legislation will establish comprehensive regulation and oversight of all insurance and reinsurance companies operating in Nigeria

The Senate passed the bill in December 2024, and the House of Representatives passed it in March 2025.

The Insurance Industry Reform Act introduces a wide array of reforms, including a significant increase in the minimum capital requirements for insurance firms.

It also implements a Risk-Based Capital (RBC) framework, requiring insurers to assess and maintain capital levels in line with the various risks they face, such as insurance, market, credit, and operational risks.

The new Act introduces critical measures such as stringent capital requirements to ensure the financial soundness of operators, enforcement of compulsory insurance policies to enhance consumer protection, digitisation of the insurance market to improve access and efficiency, zero tolerance for delays in claims settlement, creation of dedicated policyholder protection funds, especially in cases of insolvency and expanded participation in regional insurance schemes, including the ECOWAS Brown Card System.

“This development reaffirms the administration’s commitment to financial stability, economic development, and inclusive growth.

Post comments (0)